This Credit Lending User Service Agreement (the "Agreement") is an agreement between the Platform (also referred to as the "Platform") and the user ("you") in relation to your use of the lending service provided by the Platform (the "Service"). (the "Service"). By accessing, logging in to, and using the Platform and any of the Services provided, you acknowledge that you have read, understood and accepted all of the terms and conditions set forth in this Service Agreement. If you do not agree to any of the terms or conditions of this Agreement, please stop accessing the Platform and stop using the Services. If you continue to access the Platform or use the Service, you are deemed to have unconditionally agreed to the entire contents of this Agreement.1. Scope and Application of this Agreement. This Agreement applies to your use of the Platform for Credit lending activities.2. Risk Notice: When you make credit borrowing and lending in this platform, you may get higher investment income. In order for you to better understand the risks involved, in accordance with the relevant laws and regulations, administrative rules and relevant national policies, we would like to provide you with a reminder of the risks involved in pledging and lending, please read it carefully and in detail. The risks involved in your pledging and lending on the platform include but are not limited to(1) Risk warning: The platform guarantees that all information, programs, texts, etc. contained in the platform are completely safe and free from any interference and damage by viruses, Trojan horses and other malicious programs. If you login, browse any other links, information, data, etc. are your personal decision and bear the risk and possible loss.(2) Risk of force majeure: The platform is not liable for any loss due to maintenance of information network equipment, failure of information network connection, failure of computer, communication or other systems, power failure, encounter with hacker attacks, weather, accidents, strikes, labor disputes, riots, uprisings, riots, lack of productivity or production materials, fire, flood, storm, explosion, war, bank or other partner reasons, digital asset market collapse, governmental acts, orders of judicial or administrative authorities, other acts beyond the control of the platform or beyond the platform's ability to control, or third parties, which result in the inability to provide services or delays in services, and the losses caused to you, the platform shall not be liable.(3) Risk of being seized and frozen. When the authorities present the corresponding investigation documents and request the platform to cooperate with the investigation of your account, assets or transaction data in the platform, or take measures to seize, freeze or transfer your account, the platform will assist in providing your corresponding data or carry out the corresponding operation in accordance with the requirements of the authorities, and the user will bear all the responsibility for the privacy leakage, account inoperability and losses caused by this. Responsibility.(4) Other risks: you shall bear the losses arising from the following circumstances: (a) losses due to your loss of account, forgotten password, improper operation, investment decision mistakes, etc.; (b) losses caused by malicious operation by others after the online commission and hotkey operation is completed without timely exit; (c) losses caused by entrusting others to act as your agent for pledging and lending on the platform; (d) Other unexpected events and losses not caused by the Platform.Special Note: You should control your own risk by participating in lending on this platform, assessing the value of your asset investment and investment risk, and bearing the economic risk of losing your entire investment; you should conduct transactions according to your own economic conditions and risk tolerance.3. Definitions. For purposes of this Agreement, the following terms shall have the following definitions.

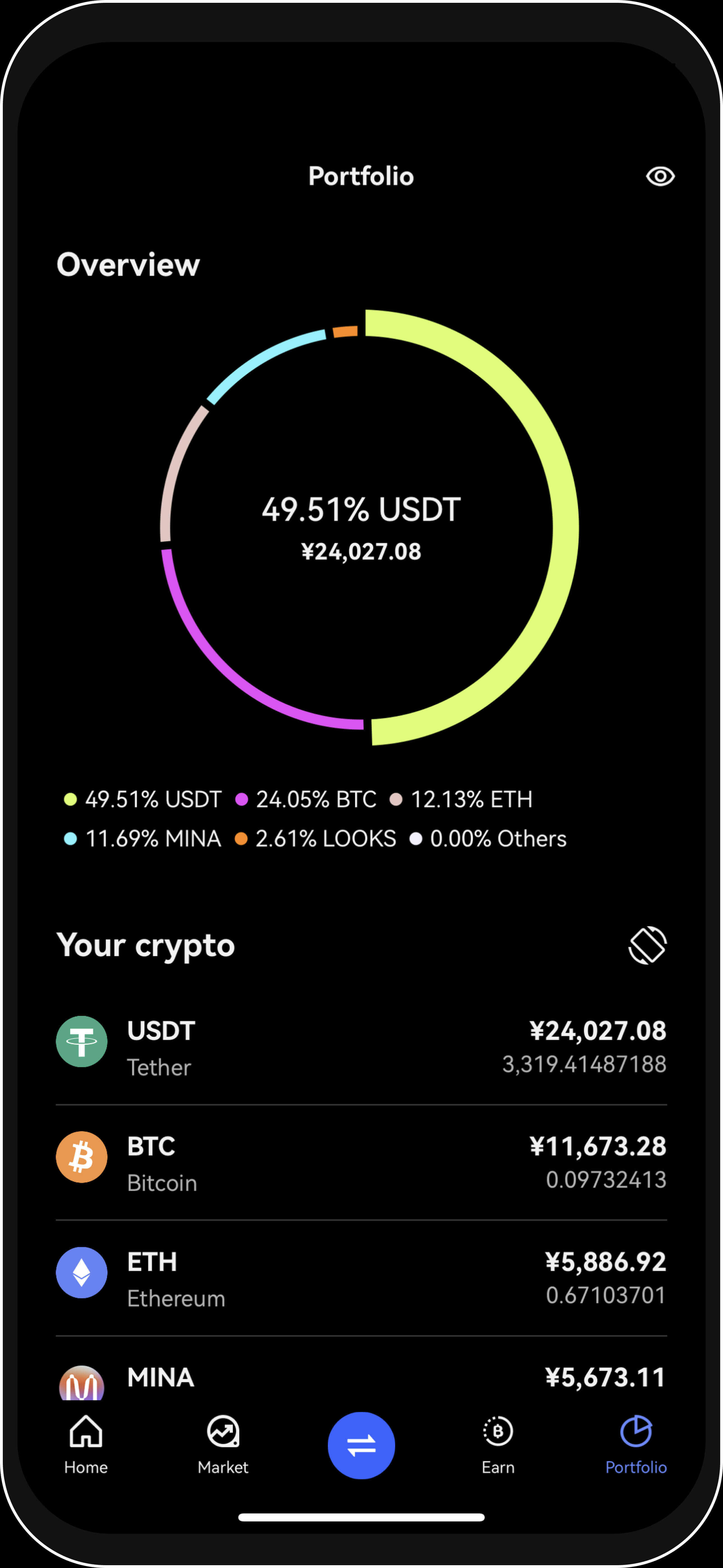

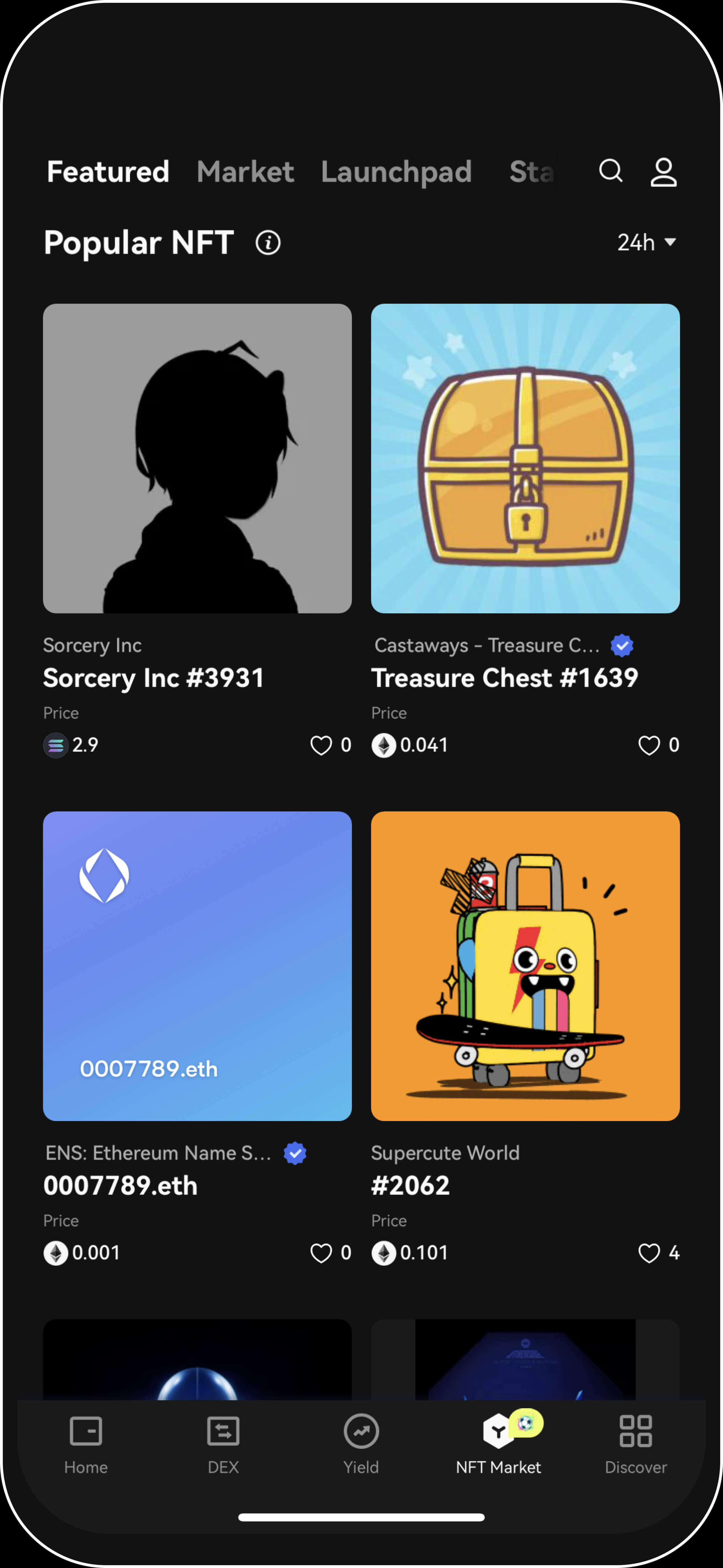

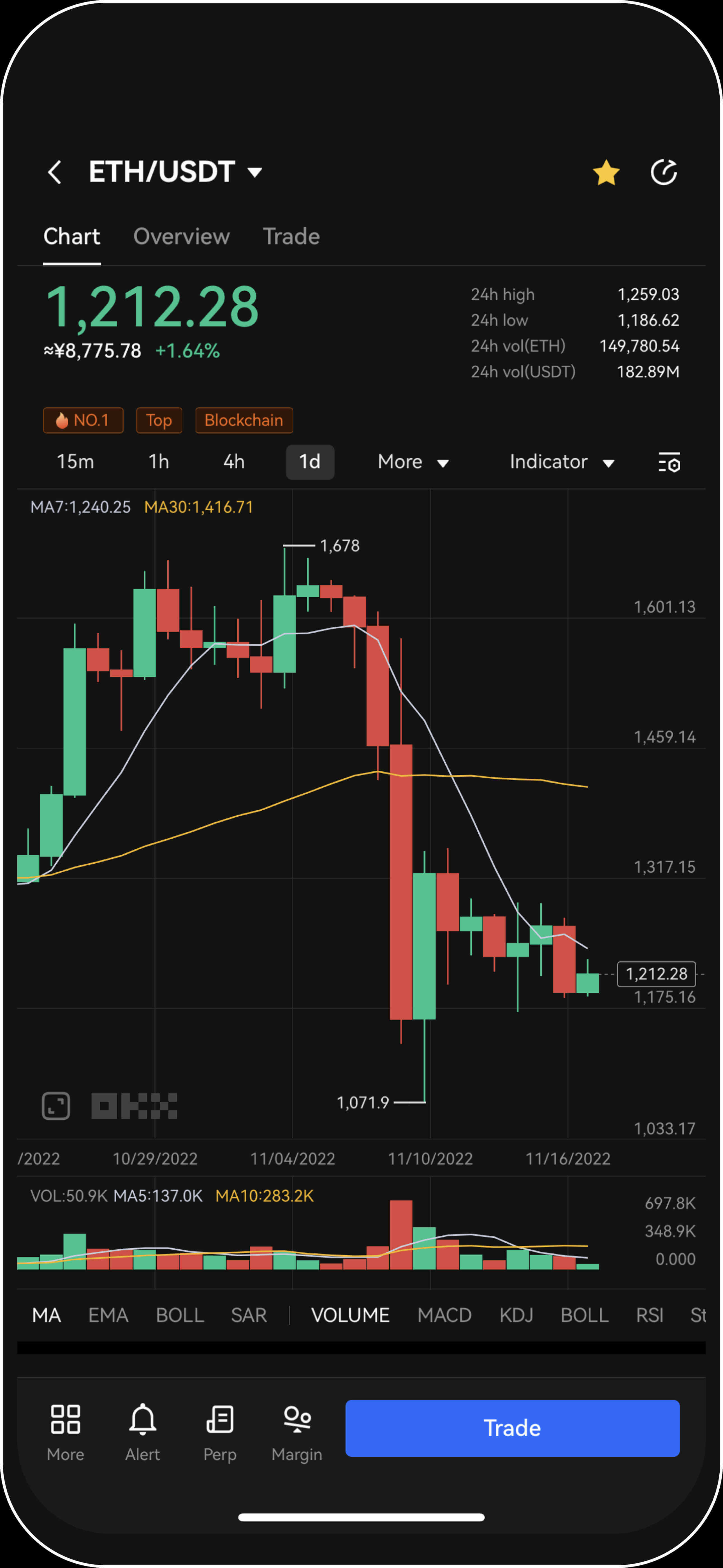

(1) Borrowing and lending: the act of pledging certain monetary assets on the platform and borrowing certain monetary assets from the platform: the act of voluntarily applying for a loan from the platform and using the funds of the platform for bidding, transferring, withdrawing and other operations (3) Applying for a loan: after logging in to the platform, click on “Collect” on the page of the loan function. After clicking “Collect Money”, the system will automatically review your loan application. After the loan application is approved, the system will automatically issue loan funds to your account and temporarily transfer the funds in your wallet to your account as loan funds, and both the account funds and the loan funds can be used for NFT Bidding transactions. You can withdraw all the funds from your account after returning the loan and interest within the specified time. Lending Interest: is the interest that you need to pay to the Platform when you use the lending services provided by the Platform, the interest is calculated according to the daily interest rate, the daily interest rate is (0.1%-0.3%), for example: you participate in a loan of 50,000 USDC for a period of 10 days, if the daily interest rate is 0.1%, then your interest for 10 days will be 500 USDC.(5) Lending days: 7 days to 30 days(6) Use of borrowed assets: The borrowed assets will be issued to your account, and you can use them for bidding and trading of works on the platform to gain income.(7) Repayment provisions. The funds in the account shall not be used for repayment, and the profit gained on the platform during the borrowing period shall not be used for repayment. Platform users need to deposit additional corresponding repayment funds and interest to your wallet for repayment. After the deposit is completed, you can apply to the customer service department to return the borrowed funds, and after the repayment approval is completed, you can withdraw any funds in your account at will.(8)Voluntary behavior. Your borrowing and lending on the Platform is entirely a voluntary transaction based on your own financial situation and understanding of the risks involved. Once a lend is in effect, it is irrevocable.(9)Application for extension. You need to provide your identity document and the reason for the extension. The specific number of days of extension is subject to the result of the audit department's review of the extension.(10) Users shall comply with the relevant laws and regulations and the provisions of this Agreement (including the version updated by the Platform from time to time) when using the Services.(11) Any agreement and terms signed between the user and the platform in relation to the use of the platform services and any disputes arising therefrom shall be the sole responsibility of the platform to resolve.

| Loan Amount |

10,000 USDT |

| Loan Time |

2023-11-15 至 2023-12-15 |

| Estimated Interest |

150 USDT |

| Due Repayment |

10,150 USDT |

Important Notice:

- Please ensure full repayment by the due date

- Late payment will incur additional penalty interest (0.1%/day)

- Early repayment may reduce partial interest